The importance of avoiding the market’s latest fixation

In financial markets, the subject of the current prevailing narrative can sometimes come to dominate the behaviour of some investors, at least in the short term. Take the theme of artificial intelligence (AI), for example, which has been creating substantial excitement in the stock market since OpenAI announced the launch of its generative AI tool, ChatGPT, in March 2023. Since then, it has at times felt as though stocks that are linked to the AI theme were the only things that mattered, at least as far as the media is concerned.

Over-enthusiasm for a particular theme like AI can lead to investor mistakes, however, and we would always caution against chasing the hype. The prevailing narrative can and does change on a regular basis, and what performs well in one year will not necessarily do well in the next. It can also lead to investors becoming blinkered, raising the risk that they become too concentrated on particular theme and miss out on other opportunities and the important broader benefits that genuine diversification can bring.

Investment success stories can come in all sorts of shapes, sizes and colours. The tale of Games Workshop was recently provided to me as an excellent example of an unlikely and underappreciated success story in the UK stock market.

Games Workshop is the company that created Warhammer, the tabletop miniature wargame for hobbyists, where players collect, paint and battle with detailed models in rich fantasy universes. It is a business that most investors do not pay much attention to, but it has several interesting characteristics. It has zero debt, it manufactures everything in the UK, it has a mutually beneficial relationship of respect and loyalty with its customers and, largely as a result, it is one of the few shops on the high street that always seems to be busy.

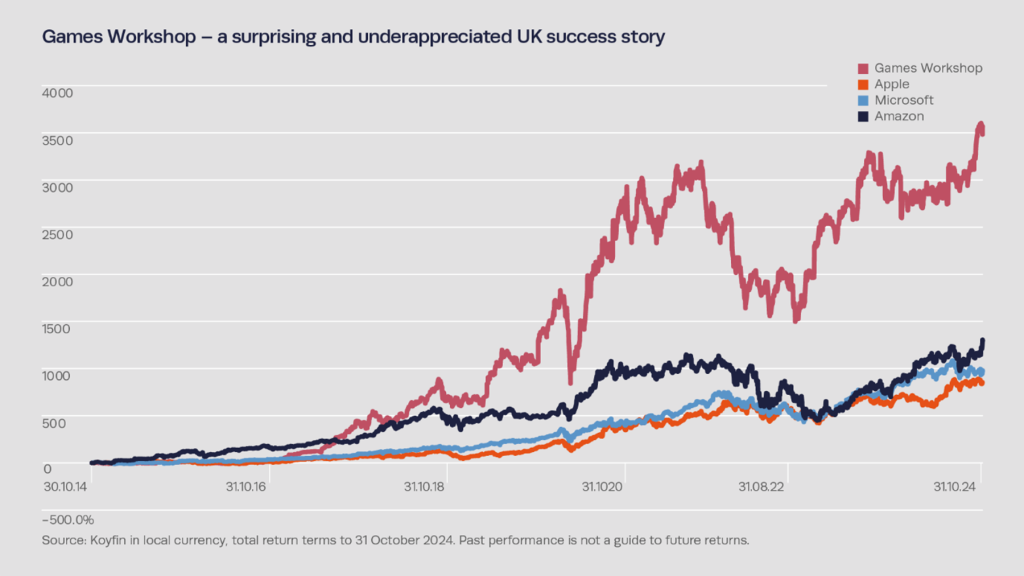

Over the last ten years, Games Workshop shares have gone from £5.49 to £119.601. It has significantly outperformed the FTSE All-Share and, perhaps surprisingly, it has approximately tripled the returns of current stock market favourites like Apple, Amazon and Microsoft.

This is not a complete analysis of the merits of this stock, which has also lost significant value at points, and Cavendish Medical is not authorised to recommend individual stocks to its clients. This is not a recommendation to buy or sell Games Workshop or any other security. Rather, it is a reminder that, even in a world currently obsessed with the future (unproven and as yet unknown) potential of artificial intelligence and technology more broadly, value can appear in many forms and in many different places. In the case of Games Workshop, it comes in the form of a paintbrush, plenty of imagination and a determination to do one thing extremely well.

Holding too many eggs in one basket is not, we are often told, a sensible strategy in many parts of life. In an investment sense, the lack of diversification that may stem from being allured by the stock market’s latest obsession, can lead to an increase in concentration risk.

At Cavendish we believe in diversification. The portfolios we recommend for our clients are formed by owning a little bit of practically everything. This means holding some – but not too much – of whatever is grabbing the market’s attention at any particular point in time. It means having some exposure to the AI theme that is currently dominating the market narrative, but it also means having a modest exposure to companies like Games Workshop. It is a disciplined investment approach that aims to avoid disappointment by simply harvesting the overall market’s return, whether it is generated by seven stocks or seven hundred of them. This diversified and disciplined strategy aims to avoid the temptation of the market’s latest fixation, wherever it may lie.

1 Source: Koyfin from 31 October 2014 to 31 October 2024. Past performance is not a guide to future returns.

Other articles: