Is gold worth its weight in a portfolio?

For centuries, gold has been a symbol of wealth, security and power, from ancient Egypt to modern financial markets. Today, it remains an asset of interest for investors seeking diversification and protection against uncertainty. However, with evolving markets and investment strategies, this article explores the practical benefits that gold may offer for the modern diversified portfolio.

A tarnished inflation shield

Gold’s reputation as a hedge against inflation is one of its strongest selling points. The idea is that, unlike modern ‘fiat’ currencies – which are not backed by a physical commodity and instead hold value simply because they are issued and accepted by governments – gold will retain its worth even as inflation rises.

Until the 1970s, currencies were tied to gold under the ‘gold standard’ and later the Bretton Woods system. With the end of Bretton Woods, most currencies became ‘floating’, with their value being set by market forces rather than tied to the price of gold. This led to concerns about inflation and currency devaluation and, indeed, the global economy did experience high rates of inflation soon after Bretton Woods was abandoned.

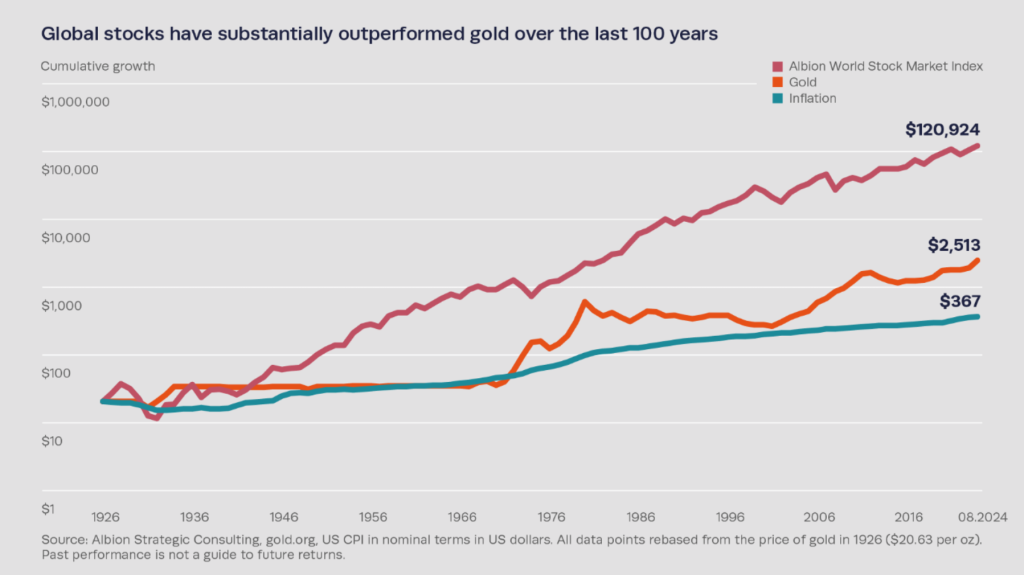

Arguably, this enhanced gold’s reputation as a safe haven asset, but in reality, its performance as an inflation hedge since then has been quite patchy. Gold’s value did surge in the 1970s high inflation but in more recent inflationary periods, its record has been inconsistent, suggesting that its ability to protect against inflation may be less reliable than often assumed. For modern investors, other assets, such as commercial property or dividend-paying stocks, may offer a more reliable method for beating inflation. This is amply demonstrated by the chart below, which shows that global equities have delivered a substantially superior outcome to gold over the last century.

The alchemy of diversification and geopolitics

Gold is also seen as a helpful diversifier because it has historically exhibited a low correlation with traditional assets such as stocks. Similar to government bonds, the gold price sometimes moves in the opposite direction to the stock market, particularly during downturns such as the global financial crisis. This can reduce overall portfolio volatility, particularly in more challenging conditions, making it a potentially attractive diversifier.

However, the current landscape reveals another dimension to gold’s allure. There is a geopolitical angle to its demand, particularly from emerging economies like Russia and China. In recent years, these countries have reportedly been increasing their gold reserves in an effort to reduce reliance on the US dollar and to protect against potential sanctions. This additional demand has likely contributed to its recent price increase. At the same time, this demand also makes gold more sensitive to international politics, which could compromise its status as a safe haven in the future.

Liquid, but not lucrative

Modern investment vehicles, such as exchange-traded funds (ETFs), have made gold more accessible to the average investor without the need to hold physical bars or coins. These financial products offer liquidity and ease of trading, making it simpler than ever to hold gold in a portfolio without the burdensome logistics of storage or insurance costs. However, these products can be complex, and it can sometimes be hard for investors to understand whether they actually hold physical gold or if their exposure is created synthetically through derivatives, which can introduce an additional layer of risk. Derivatives are contracts to buy or sell an asset at a fixed price in the future, which are used to gain exposure to the performance of an asset without actually owning it.

Meanwhile, gold’s improved accessibility does not mitigate one of its core drawbacks. Unlike equities, which pay dividends, or bonds that offer interest, gold offers no income. This makes it difficult to value and means that its price is purely a function of supply (historically very stable) and demand (which has tended to rise over time). Investors in gold are effectively speculating that others will continue to desire it even more avidly in the future.

All that glisters is not gold

Gold’s historical role as a store of value is rooted in its deep cultural significance and symbolic status across societies. Romans used it as currency, and even today, central banks around the world hold vast gold reserves as a hedge against financial instability. This association with wealth and resilience grants gold a unique psychological appeal and sense of continuity, particularly in times of economic crisis.

However, in modern portfolio construction, its role is constrained by its speculative nature, lack of income, product complexity and potential sensitivity to geopolitics. Investors have at their disposal a range of other assets that can meet risk management and return needs in ways that gold cannot.

For this reason, we do not recommend gold as a direct holding in client portfolios. It does play a small indirect role, however, through the investments that recommended funds have in businesses involved in the mining and production of gold.

While gold’s storied past grants it a certain allure, therefore, the Cavendish investment committee believes it should remain, for most investors, something to be admired as a treasured possession rather than as an element of a balanced investment portfolio.

Other articles: